Further upgrade governance regarding

fairness, transparency and effectiveness

The JCU Group has established a system to fulfill its corporate social responsibilities by maintaining high management transparency and corporate governance functions.

Enhancing Our Corporate Governance

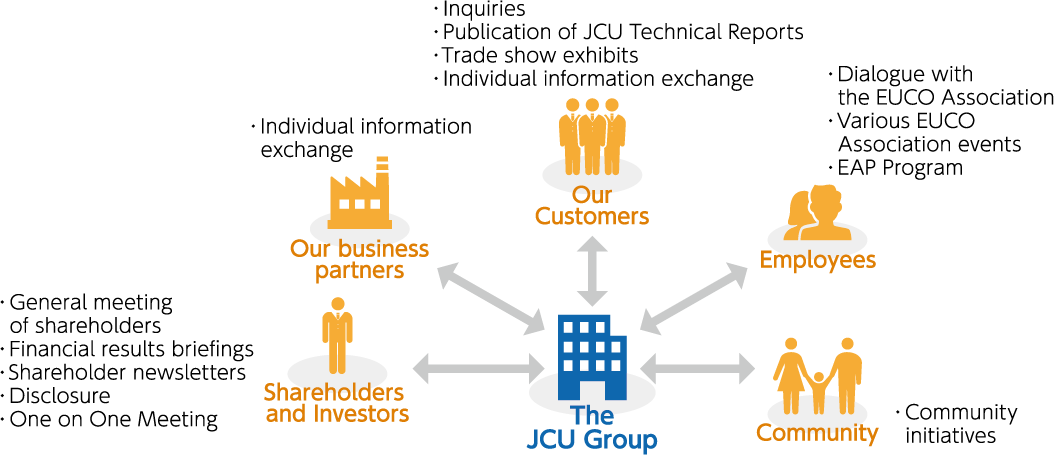

The JCU Group recognizes the importance of compliance with laws, regulations and corporate ethics, and considers it a key management mission to enhance corporate value through quick corporate decision making and by improving the soundness of management in ways that they are adapted to changing social and economic conditions. In order to achieve this, we have built good relationships with various stakeholders, including our shareholders, customers, business partners, local communities, and employees. In addition, as the company grows, we will further strengthen, improve, and refine the various functions necessary for corporate governance, while enhancing corporate governance, thoroughly practicing compliant corporate management, and building internal systems to prevent risks before they occur. At the same time, we will appropriately disclose information and improve management transparency.

Corporate Governance System

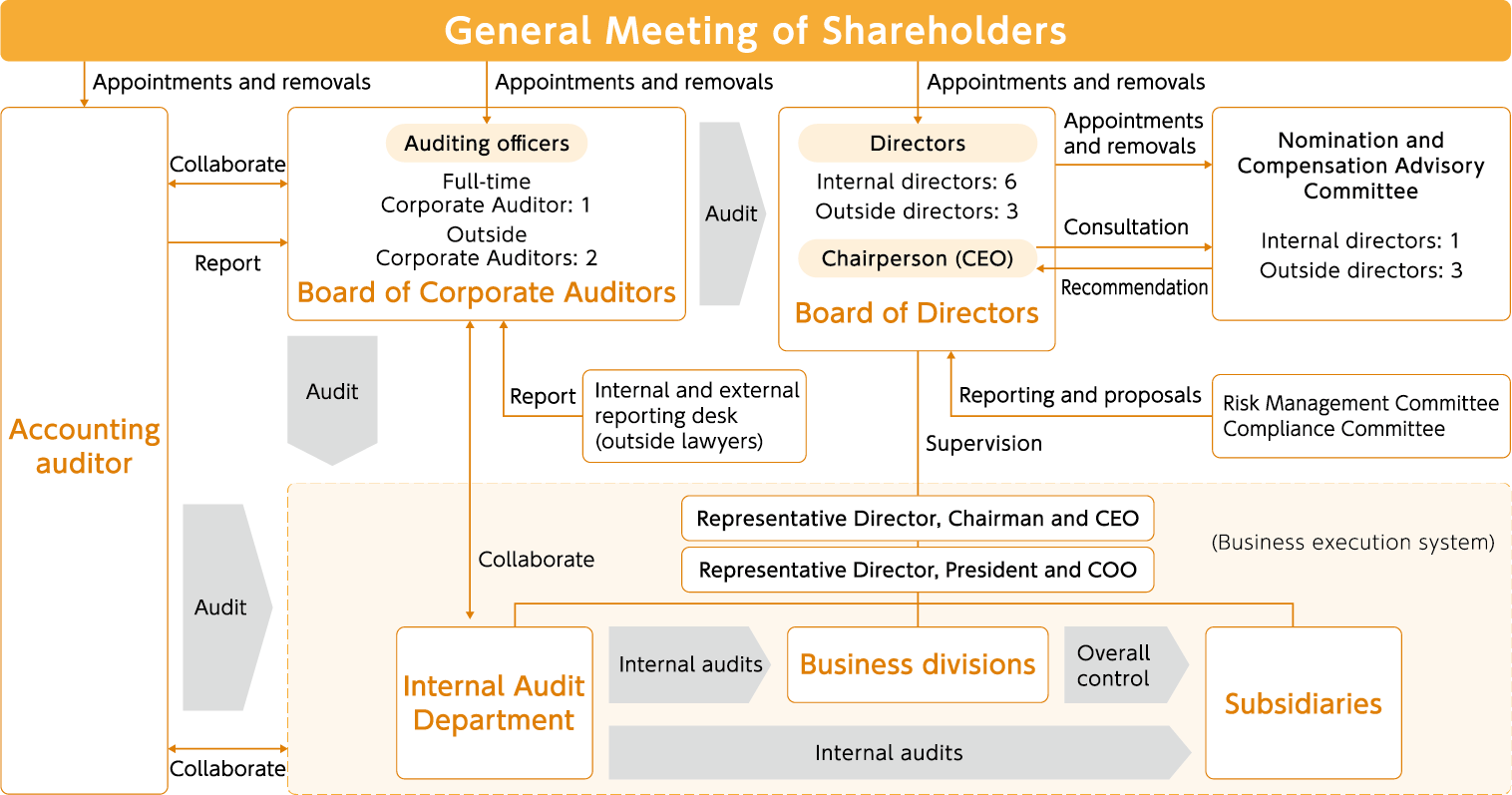

JCU has a Board of Directors as an organization that makes decisions on important management matters and supervises the status of business execution. The Board of Directors consists of 9 directors (including 3 outside directors), and in principle meets at least once a month.

In addition, we have introduced an Executive Officer system for the purpose of building a quick and flexible business execution structure. At the Management Strategy Meeting, which meets once a month and attended mainly by directors and executive officers, the status of business execution is analyzed and reviewed, and deliberations are carried out on proposals that are to be consulted on with the Board of Directors.

In addition, the JCU Group has introduced a Board of Auditing Officers system. The Board of Auditing Officers consists of 1 full-time auditing officer and 2 outside auditors. In principle, auditing officers hold Board of Auditing Officers meetings once a month, as well as attend the Board of Directors meeting to audit the legality and validity of business decisions.

Schematic of the corporate governance system

CSR Policy

We have established four CSR policies to contribute to the sustainable development of societies.

Communication with Stakeholders

The JCU Group places great importance on communication with our stakeholders in order to meet the expectations of society.

In-house Education on Sustainability

The JCU Group provides in-house training on sustainability as necessary in order to become a "global company that continues to grow together with society by maximizing its unique strengths and contributing to the environment and society".

In FY2024, we explained our TCFD and CDP initiatives—in some instances in web conferences—to executives and employees at our domestic offices and overseas subsidiaries.

Initiatives for SDGs

The SDGs consist of 17 goals for realizing a sustainable world.

The JCU Group will continue its efforts to contribute to these goals as much as possible.

・Soraputi Kids’ Camp

・Employees

・Water consumption volumes

・Use of renewable energy

・Comfortable working environment

・Business activities and Sustainability

・Respect for human rights

・Community

- ・Our Customers

- ・Business activities and Sustainability

・Carbon offsetting

- ・Business activities and Sustainability

- ・Wastewater and Waste

- ・Carbon offsetting

- ・Wastewater and Waste

・Corporate governance

- ・Carbon offsetting

- ・Soraputi Kids’ Camp

- ・Our business partners

Executive Compensation System

Executive Compensation System

①Basic Policy

②Compensation structure and levels

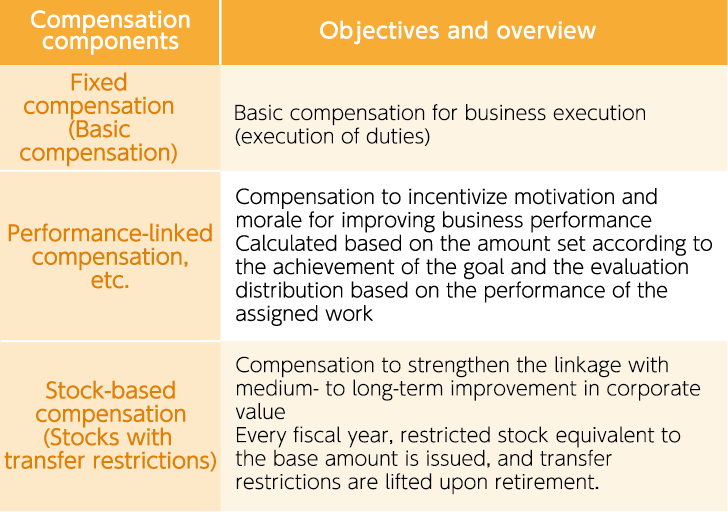

Compensation for directors other than outside directors

Compensation consists of fixed compensation (basic compensation), performance-linked compensation and other variable compensation, and stock-based compensation. The level of compensation is set at an appropriate amount, based on the responsibilities and number of directors of the company, as well as future changes in the business environment, etc.

Compensation for outside directors and audit & supervisory board members

Outside directors who perform supervisory functions are paid only fixed compensation (basic compensation). The compensation of Audit & Supervisory Board Members consists of only fixed compensation, with a view to emphasizing independence and objectivity from management. The compensation amount of each Audit & Supervisory Board Member is decided through consultation.

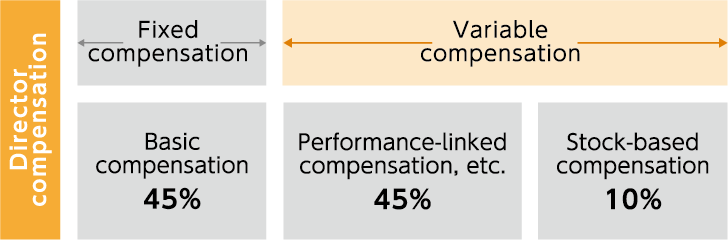

Guideline for the ratio of compensation for directors excluding outside directors

③Compensation determination procedure

Compensation for executive directors consists of fixed compensation (basic compensation), performance-linked compensation, and stock-based compensation. The specific details of individual compensation amounts are delegated to the Representative Director and Chairman based on a resolution of the Board of Directors. In order to appropriately exercise the delegated duties, the Chairman shall submit a draft to the Nomination and Compensation Advisory Committee, receive a recommendation, and make decisions in accordance with the contents of the recommendation.

Guideline for the ratio of compensation for directors excluding outside directors

Policy on cross-shareholdings

With regard to cross-shareholdings, we may hold listed shares of our business partners, etc., with the aim of increasing our corporate value in the medium to long term, after comprehensively considering whether a cooperative relationship is necessary from a business strategy perspective. When holding shares, the Board of Directors regularly reviews whether and to what extent the holding is meaningful, as well as the economic rationale of whether the cost of holding the shares, calculated based on the cost of shareholders' equity and the cost of after-tax debt, exceeds the amount of contribution the shares make to the business. As a result of these reviews, we reduce shares that do not match with our holding policy.

With respect to exercising our voting rights, we respect the management policies and strategies of the investee companies and make comprehensive decisions not only from the perspective of shareholders, but also from the perspective of whether the action will lead to the enhancement of our corporate value as a business partner.