VALUE CREATION & STRATEGY

Business Activities and Strategies

Business Activities and Strategies

Since the company’s founding in April 1968, the JCU Group has supported the growth of the automotive, electronics, and other industries with a focus on providing a variety of surface treatment technologies, most of which have their roots in decorative and rust-proof plating technologies.

With respect to JCU Group’s direction over the medium- to long-term, we defined our corporate vision for 2035 as becoming a "A global organization that continuously grows with society by fully utilizing distinctive strengths and making contributions to society and protecting the environment."To this end, we aim to improve our corporate value by pursuing social and economic value by constantly strengthening our technical and service structures while addressing the ever-changing social environment.

Overview and Strategy of Our Chemicals Business

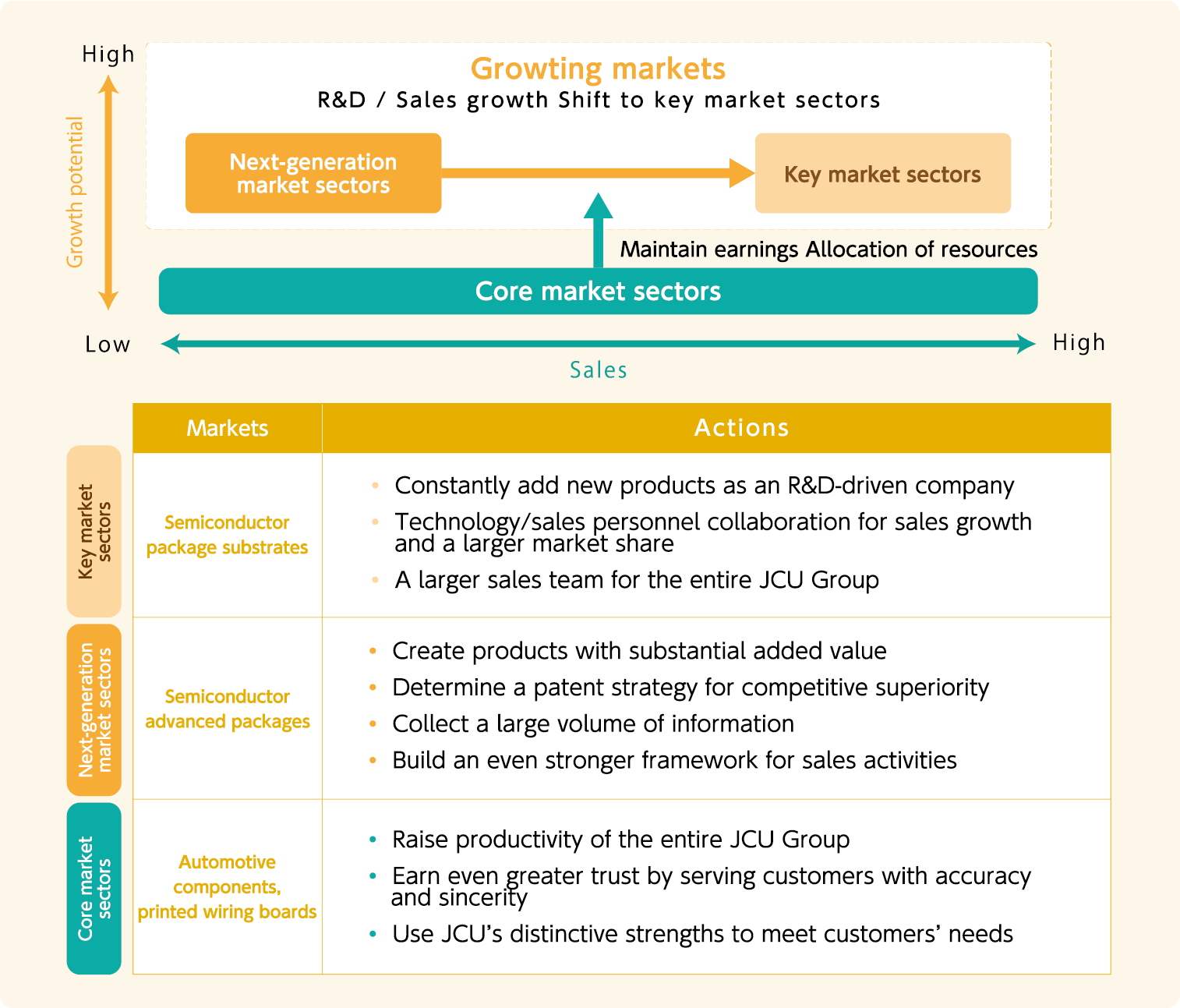

In our chemicals business, we are engaged in the development, manufacture and sale of surface treatment chemicals, and the sale of related materials for the Japanese and international markets. Our surface treatment chemicals are grouped into two categories: decorative/functional and electronic. And in order to grow our company, we actively invest profits from our chemicals businesses for automotive parts and printed circuit boards—our foundation areas—in growth sectors, particularly in two areas in the electronics domain: the semiconductor package substrates sector—our priority area— and the advanced semiconductor packages sector which we position as one of our next-generation areas.

We currently operate at 13 sites in 11 countries, and the percentage of overseas sales in our Chemicals business has grown to nearly 80%. We will continue to strive to gain the trust of our customers both in Japan and overseas by maintaining a globally connected, swift and extensive support system, making proactive investments, and continually developing high-quality products.

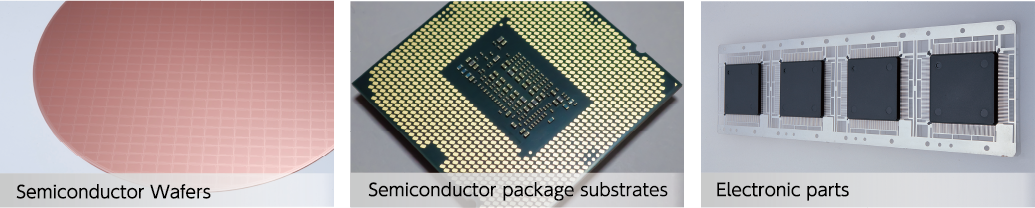

Electronics Field

In the electronics field, we primarily develop, manufacture and sell surface treatment chemicals for high-density printed circuit boards and semiconductor package substrates used in high-performance electronic devices such as smartphones, PCs, tablets and servers. In recent years, in addition to the "CU-BRITE" series of Via Filling acid copper plating Processes—our flagship product—we have launched a new brand, "TIPHARES," for semiconductor-related products, and are developing products for semiconductor areas with more demanding requirements.

Going forward, we will continue to work on product development that meets increasingly sophisticated performance requirements, and aim to expand our product lineup and quickly establish the TIPHARES series in the market.

Decorative and Functional Fields

In the decorative and functional fields, we mainly develop, manufacture, and sell surface treatment chemicals used on automotive parts and water faucet parts. As environmental conservation efforts progress and regulations become stricter in the sectors we operate, it has become essential to develop environmentally friendly plating chemicals.

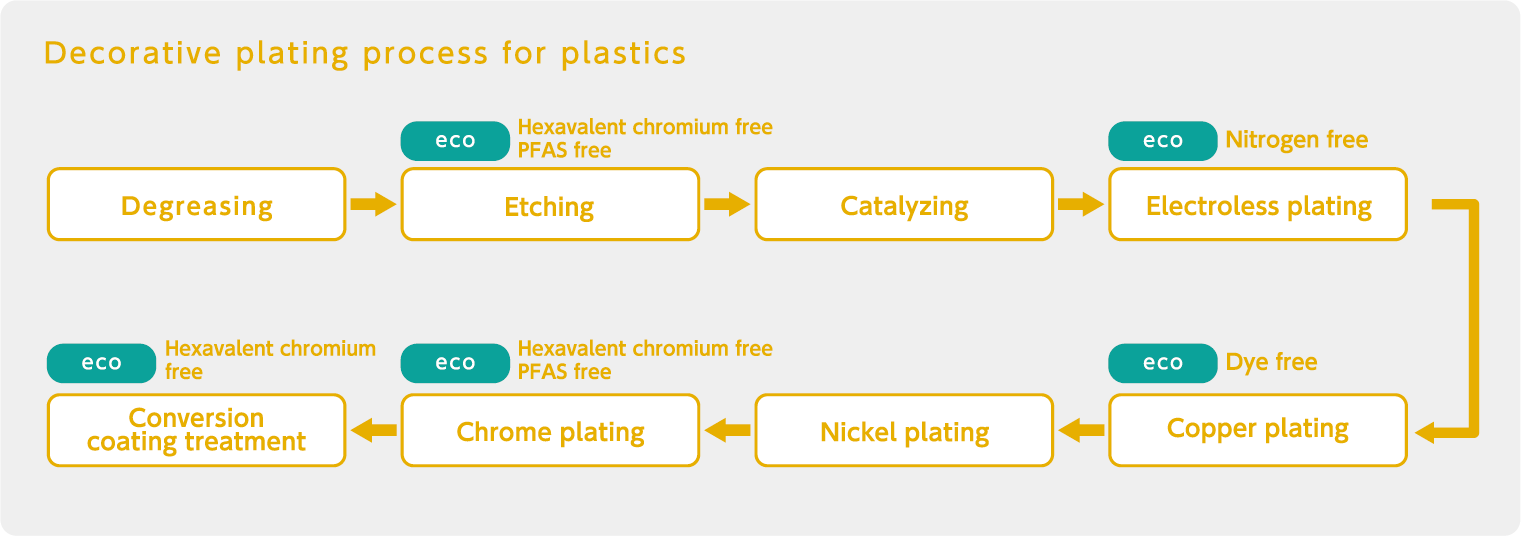

We have developed processes that do not use hexavalent chromium, a hazardous substance, as well as products that do not contain nitrogenous compounds, Per- and Polyfluoroalkyl Substances, and have established a system that allows us to offer products that have smaller environmental impacts throughout their entire process.

Going forward, we will continue to work on developing environmentally friendly products, and aim to expand our product lineup and quickly establish them in the market.

Overview and Strategy of Our Equipment Business

In our equipment business, both in Japan and overseas, we are involved in everything from design to manufacturing and sales. Our fully automated and precisely developed surface treatment equipment are used in a variety of sectors, including the automotive and electronics-related industries. Based on the concept of "integrated sales of systems and chemicals," which has been our philosophy since the time our company was founded, our equipment division also takes part in the R&D of chemicals.

And through verifications—from the viewpoint of equipment mechanisms—of technical issues that cannot be resolved with chemicals alone, we promote the development and sales of differentiated equipment that maximize the performance of chemicals. In addition to plating equipment, we also sell printed circuit board etching and cleaning equipment that use plasma technology which has a high affinity with chemicals, and other equipment that support high-density manufacturing technologies.

JCU VISION 2035 -1st stage-|Investments in Growing Markets

Business Activities Report/Sales

Business Activities Report/Sales

To achieve the sales targets stated in "JCU VISION 2035,"

we will work to improve profitability in existing sectors,

develop new markets, and further strengthen our sales structure.

General Manager of Sales Headquarters

Fumihiko Araake

The Sales Division’s role in the Medium–term Management Plan

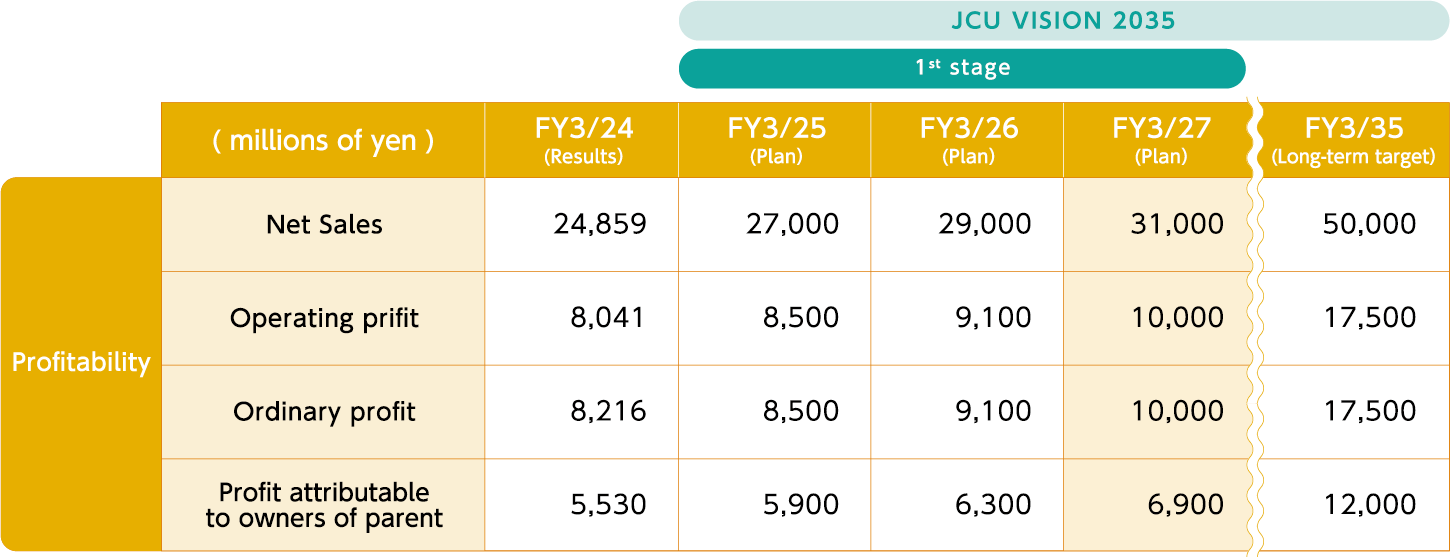

"JCU VISION 2035" sets a goal of achieving sales of 31 billion yen in the fiscal year ending March 2027, which is the final year of the Medium-term Management Plan , and upholds a longer-term vision of 50 billion yen in the fiscal year ending March 2035. To achieve these goals, the Sales Division will continue to grow existing businesses while aggressively expanding sales into new markets.

Initiatives to Ensure the Profitability of Existing Businesses

The main targets of our existing businesses include decorative parts such as door handles and emblems for automobiles made by plating on plastics, as well as electronic parts such as printed circuit boards and semiconductor package substrates.

The decorative and functional fields has seen a decline in demand for decorative plating in recent years due to the shift to electric vehicles and changes in design trends. That being said, since this is also a sector where environmental awareness is high, there are major business opportunities for products that reduce environmental impact. Decorative plating on plastics typically requires more than ten processes, the first and last of which involve treatment with hexavalent chromium, a hazardous substance. Hexavalent chromium has long been subject to regulation as a substance of concern,

but due to its high performance, substitutes have been slow in forthcoming. This year, we developed a decorative plating process that eliminates hexavalent chromium from all steps. In addition, we provide a wide range of environmentally friendly products for each process, such as nitrogenous compound-free electroless nickel, chrome plating mist suppressants that do not contain Per- and Polyfluoroalkyl Substances(PFAS), and dye-free glossy copper sulfate, enabling us to establish systems that allow us to propose solutions for the entire process. We have received many inquiries from customers, and will continue to strive to establish these products in the market.

Meanwhile, the electronics fields started off last year in a difficult business environment due to factors such as sluggish personal consumption and the impact of inventory adjustments for semiconductors. That being said, demand for printed circuit boards in particular is recovering, and while recovery in the market for semiconductor package substrates remains slow, there is also expected to be more activity going forward in this market due to growth in AI-related demand for data centers, etc., and replacement demand for smartphones and PCs. We have also successfully commercialized new products that meet increasingly sophisticated performance requirements, and we will continue to focus on expanding our market share of these products.

JCU VISION 2035 -1st stage-|Performance Targets

Market Development Through Our New "TIPHARES" brand

The miniaturization of wiring, which has been progressing at an accelerating pace in recent years, is reaching its physical limits, and this is creating demand for packaging technologies that use new wiring formation and bonding techniques. This is called advanced semiconductor packaging, and various methods are currently being considered in this sector.

Our new brand, the "TIPHARES" series, announced in November 2023, is a product brand that targets next-generation semiconductors, including the semiconductor advanced packaging sector. Acid copper plating and etching technologies—technologies that we excel in—are essential to the process of manufacturing advanced semiconductor packages, and we aim to enter new markets with a lineup of new products.

an accelerating pace in recent years, is reaching its physical limits, and this is creating demand for packaging technologies that use new wiring formation and bonding techniques. This is called advanced semiconductor packaging, and various methods are currently being considered in this sector.

Our new brand, the "TIPHARES" series, announced in November 2023, is a product brand that targets next-generation semiconductors, including the semiconductor advanced packaging sector. Acid copper plating and etching technologies—technologies that we excel in—are essential to the process of manufacturing advanced semiconductor packages, and we aim to enter new markets with a lineup of new products. As of now, we have commercialized several products in the "TIPHARES" series, and we plan to continue expanding our lineup going forward. This series is already attracting attention, and we have been receiving inquiries on our website and at trade shows. We propose products that meet our customers' needs and continue to build proven track records, technical support being an essential component of these efforts.

While our technology has always had a strong affinity with semiconductors, information is of utmost importance since semiconductor technology continues to evolve at a rapid pace. In addition to improving the knowledge of all of our sales staff members, we work closely with our R&D Center and affiliated companies to constantly incorporate the latest information to establish our products in the market early.

Strengthening Our Sales Structure by Leveraging Our Strengths

We have been able to expand our market share through our technical sales efforts, that is, working closely with our customers and gaining their trust in our ability to make proposals and provide solutions. We provide ongoing training for our staff to ensure that we are able to maintain this strength. In order to build close relationships of trust with our customers, sales staff need a wide range of knowledge and on-site skills, including product knowledge in their field of responsibility, as well as the ability to work with other departments such as chemicals and equipment, and to provide advice to customers on solving problems that they may have.

Our current performance is due in large part to our experienced sales staff working with R&D Center staff to provide operational support for our customers' production lines. Developing the human resources necessary to support these activities is our top priority. In addition to regular training by R&D Center staff, we also hold regular report sessions and other programs to share success stories with younger employees as part of their training. We also work to develop human resources by creating a database of the experiential rules and information gleaned by our employees, and sharing this with the Sales Division. Going forward, we will continue our efforts in this area with due consideration of data utilization.

JCU's proposed process for reducing environmental impact

Business Activities Report /Development

Business Activities Report /Development

We will actively invest in growth areas,

strengthen our research and development capabilities,

and increase our development speeds to support

the sustainableand stable growth of our company.

Senior Managing Executive Officer※,

General Manager of R&D Center

Akihisa Omori

※Position at time of interview

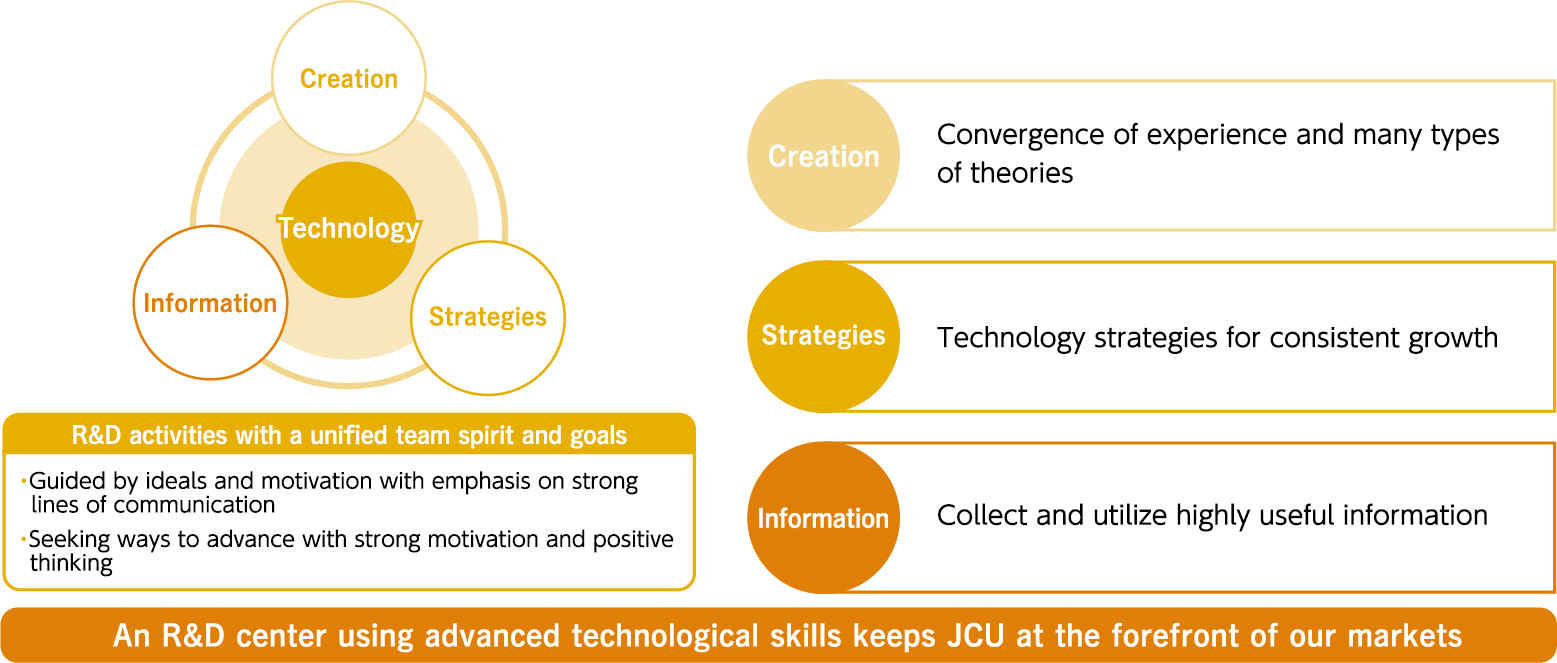

Our R&D Center’s Direction in Research and Development

We have presented our vision for our R&D Center in our latest Medium-term Management Plan. The three keywords in this vision are "Creation," "Strategies," and "Information." The first keyword, "Creation," is about "Convergence of experience and many types of theories" to enable efficient development, and create innovative products that no other company is able to produce. The second keyword, "Strategies" is about building "Technology strategies for consistent growth" and points to how clearly identifying our development goals based on marketing will lead to a shared awareness among R&D Center staff and create a driving force for growth. The third keyword, "Information," is about the "Collect and utilize highly useful information" This enables us to collect information from multiple sources, not only from our customers but also from international academic societies and universities, and to incorporate highly accurate information about technological trends into our business.

In addition to the ideas that underlie these three keywords, the actions of R&D Center staff that are grounded in a sense of ownership are what give birth to new technical capabilities. Our R&D Center must be "An R&D center using advanced technological skills keeps JCU at the forefront of our markets" and we will continue our work to realize this vision.

R&D | Our Vision for R&D

Active Forward-Looking Investment in Growth Markets

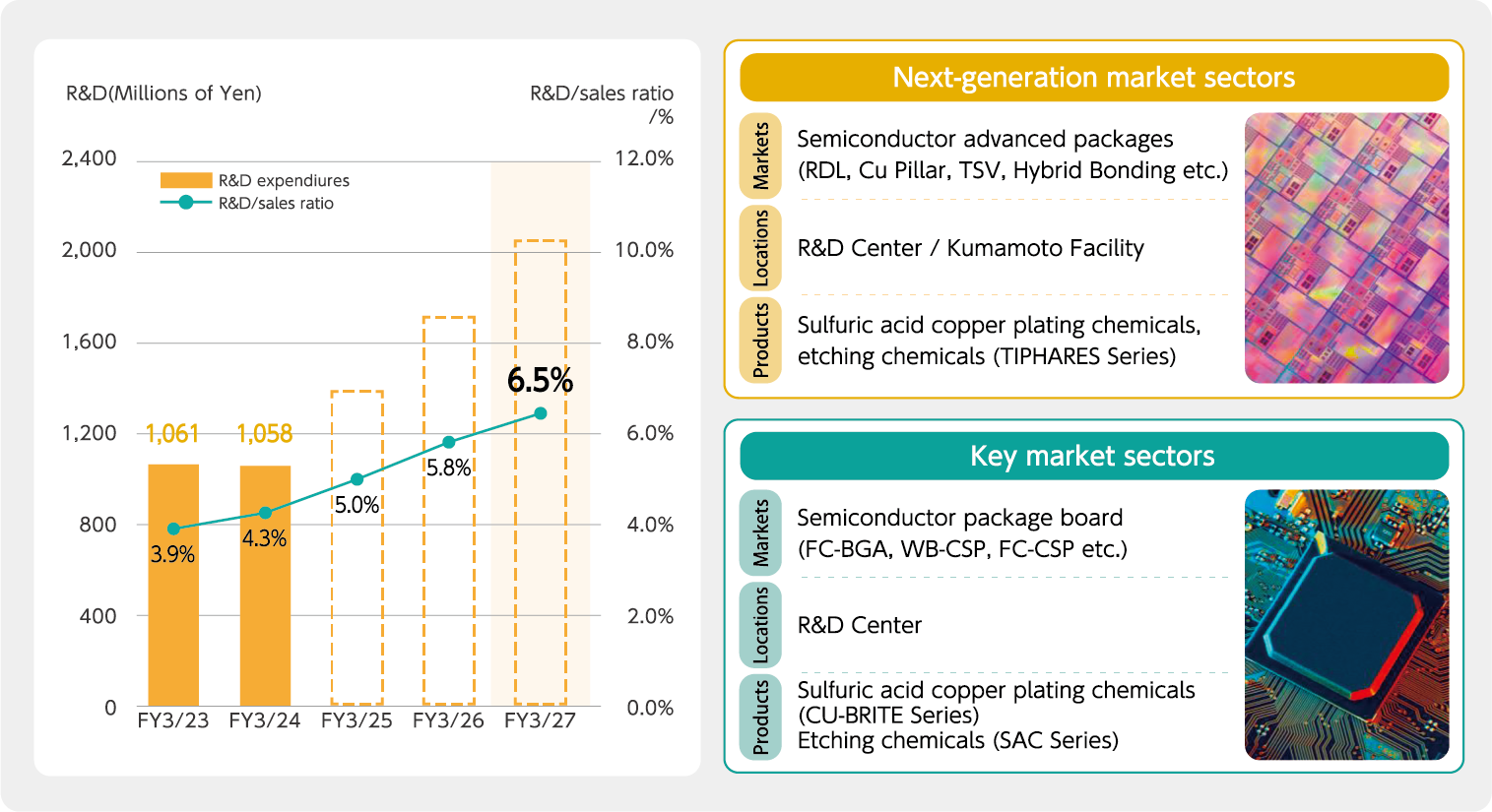

In this Medium-term Corporatev Plan, we have positioned advanced semiconductor packages and semiconductor package substrates—which have made remarkable advances in the electronics field—as growth areas. While we expect the market to continue to grow significantly going forward, chemical performance requirements are also becoming increasingly sophisticated. So in order for us to achieve sustainable growth going forward, we need to acquire commercial rights in growth areas. To this end, we have established a policy of aggressive investment in human resources and research facilities, and have made the decision to raise our R&D expense-to-sales ratio to 6.5% over the next three years.

Most recently, the construction of the Kumamoto Facility in Mashiki, Kumamoto Prefecture, consisting of a research, factory and warehouse building is scheduled to be completed in December 2025. Our total investment amount is expected to be approximately 11.4 billion yen(does not include cost of land). The existing R&D Center in Kanagawa Prefecture will continue to be responsible for R&D in all areas, from the decorative and functional fields to the electronics field. The Kumamoto Facility is also scheduled to include a research lab equipped with the latest equipment, and with its focus on semiconductor-related development, we will be able to accelerate our cutting-edge R&D in growth markets more than ever before.

R&D of High-Value-Added Products and Next-Generation Technologies

Our Development Division has been developing new products in a variety of different sectors, including our new brand "TIPHARES" series announced last year,acid copper plating and etching for semiconductor package substrates in our existing markets, as well as environmentally friendly processes for automotive decorative parts. All in all, we have developed 14 new products in the past two years. When developing these new products, we create a development roadmap in-house for creating high-added-value products and next-generation technology products that match market needs. In parallel with marketing, we make revisions as necessary to keep abreast of technological trends as we proceed with development. Additionally, research and development efforts where we use materials informatics (MI) that we have already incorporated, will become increasingly important going forward in order to keep up with ever-shortening development times, and we also plan to continue strengthening this technology.

R&D Center Initiatives for Sustainable and Stable Growth

While our company has grown by expanding overseas and increasing our share in existing markets up until now, going forward, we will need to secure our existing markets while also venturing into new sectors. For us, research and development is the foundation that all of this is built on. In order to become a company capable of achieving sustainable, stable growth, we commit not only to making ongoing improvements to the performance of our existing products, but also step up our development efforts, such as in creating products for new markets. We will also proactively invest in ways that improve the efficiency of our development efforts through the use of MI and simulation software, and also invest in the effective use of human resources, intellectual property, and intangible assets at our R&D Center.

R&D | R&D Expenditures

Financial & Capital Strategy

Financial & Capital Strategy

In order to continue growing for the

next ten years, we will promote

"growth investment" and

"shareholder returns" and aim to

further increase our corporate value.

General Manager of Corporate Strategy Office

Yoji Inoue

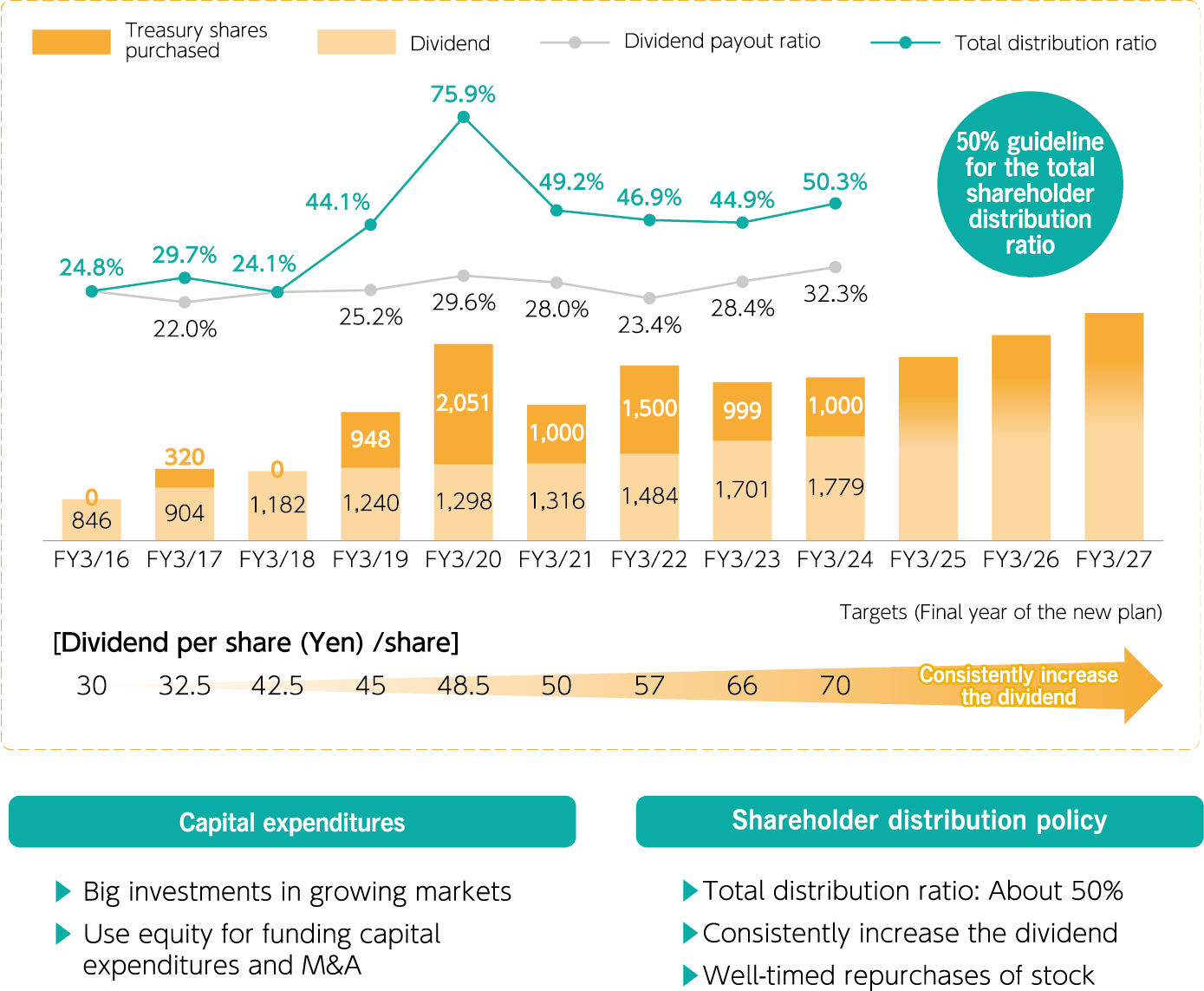

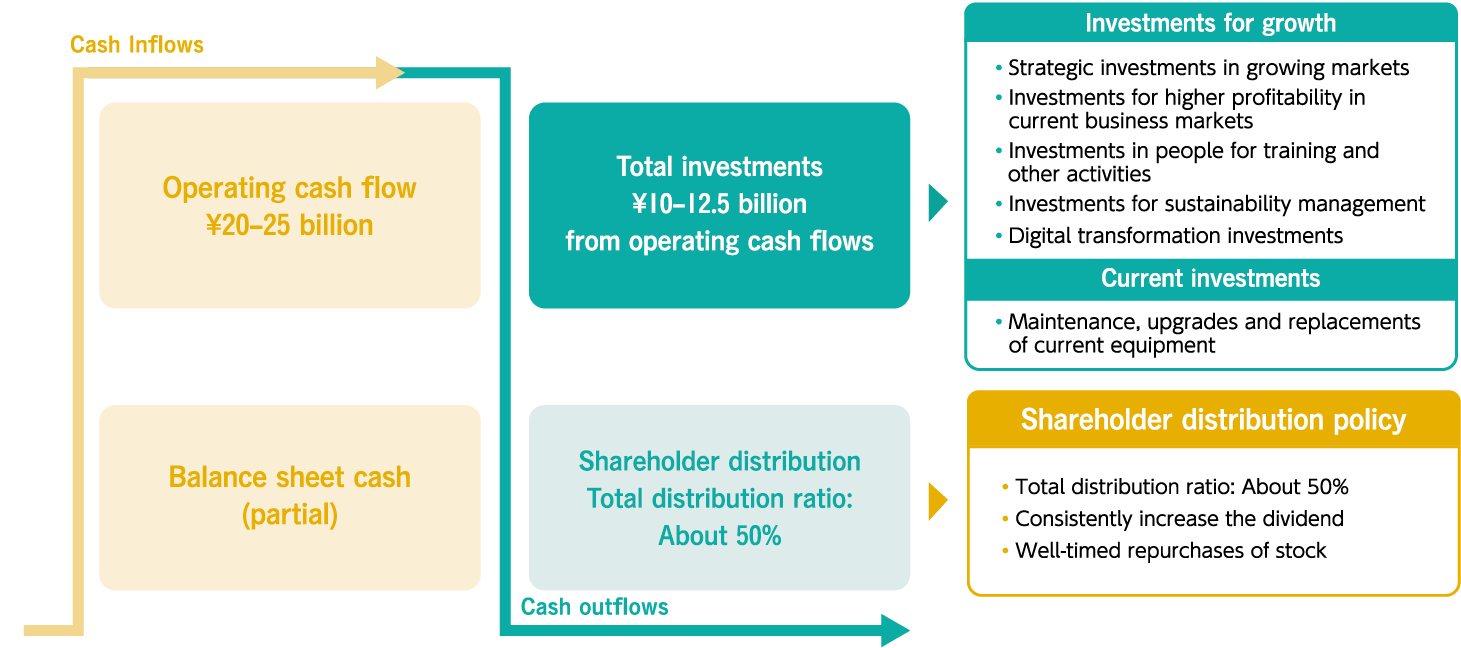

For Sustainable and Stable Growth

This Long-term vision looks ahead ten years and we have set a long-term sales goal of 50 billion yen. The plan is divided into three stages: the 1st to 3rd stages. In the 1st stage, which is three years long, we will actively implement "growth investment" and "shareholder returns" in accordance with our capital policy, and push forward to steadily achieve our numerical targets. In the long term, we will actively invest and return profits to our shareholders with the aim to improve capital efficiency and ensure sustainable, stable growth for our company.

Our growth strategy is to create a cycle of growth by allocating resources obtained in our core market sectors—automotive parts and printed circuit boards—to next-generation market sectors centering around our growth area of advanced semiconductor packages, as well as to key market sectors that are centered on semiconductor package substrates.

In particular, in the next-generation market sectors of advanced semiconductor packages, during the period of this Medium-term Management Plan, we will focus on sales and marketing activities, and during the period of the next Medium-term Management Plan, work to create an environment that will enable us to solidly generate profits.

Financial Strategy | Capital Allocation (FY3/25 to FY3/27)

Growth Investment Centered Around the Kumamoto Facility

In "JCU VISION 2035 – 1st stage–", we project an operating cash flow of between approximately 20 and 25 billion yen over the next three years. We plan to use approximately half of this amount for investment, with the majority of that amount being for our Kumamoto Facility, which will be our largest investment to date. The main sector that this facility will be involved in will be semiconductor-related, and the company will actively invest in state-of-the-art facilities and equipment. We will also promote human resource investment to utilize MI to speed up R&D and to improve efficiency, as well as sustainability investment to reduce CO2 emissions in order to fulfill our social responsibility as a company.

Towards Increasing Corporate Value Through Financial Strategies

In our latest Medium-term Management Plan, we define "growth investment" and "shareholder returns" as the two pillars of our financial strategy. In particular, with regard to shareholder returns, in addition to steadily increasing dividends and making flexible share buybacks, we have set a new numerical target of a total return ratio of approximately 50% to expand our shareholder returns policy. The proactive disclosure of necessary information is essential for increasing our corporate value. Going forward, we will continue to improve transparency in our corporate management—such as by disseminating information via our website and producing a consolidated report for the three-year period of our current Medium-term Management Plan—to increase our corporate value.

Financial Strategy | Equity Policy